Legal thesis writing service with 13-year experience

Ph.D. experts' assistance at any stage: research proposal, literature review, methodology, data collection & analysis, discussion & results, editing & revision, presentation. Research on any topic & methodology from professional thesis writers

Why you should try our thesis writing help

-

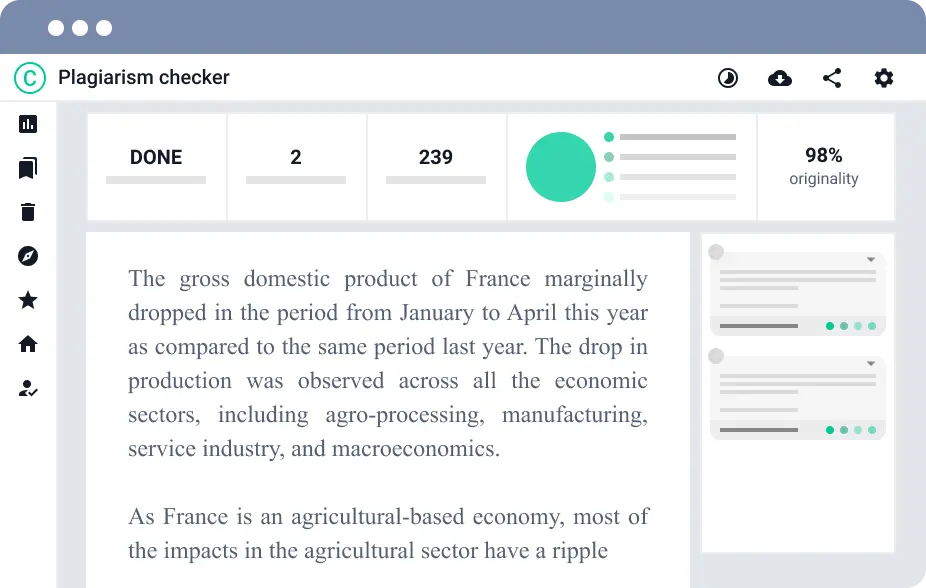

100% originality guaranteed

100% originality guaranteedBesides an original text of the necessary length, we also provide what a supervisor requires the most – unique ideas & concepts on your topic.

-

Ph.D. expert in your field

Ph.D. expert in your fieldOur thesis writers conduct actual research. We use AI to assign the order to the top-qualified PhD/MA expert, well-versed in your topic & field.

-

Highest quality or a refund

Highest quality or a refundWe provide thesis writing help under strict quality control to ensure you never get low-quality work from us. In case of any issues, you'll get a refund.

-

Get as many revisions as needed

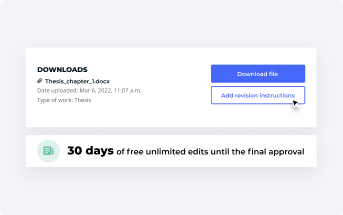

Get as many revisions as neededNo worries about the supervisor’s comments: you have 30 days of free revisions without limit. We make edits in an instant, so ask for them as much as needed until the work meets your supervisor’s approval.

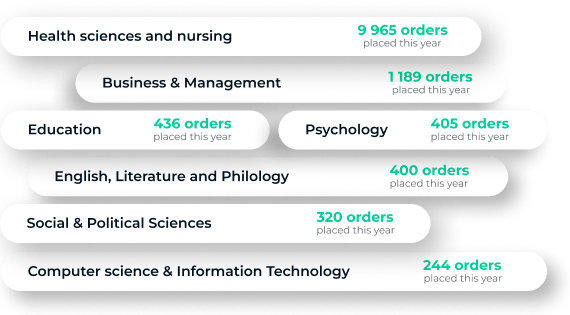

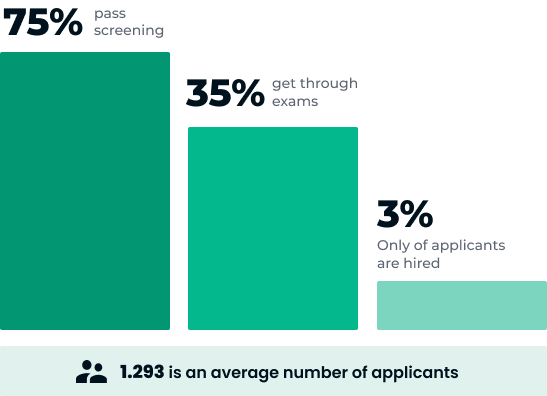

A bit about our thesis writing service in numbers since 2010

Calculate the cost of the best thesis writing service

-

Payment in parts is available

Contact a support agent to arrange payment in installments if your work is too big.

-

Money-back guarantee

If there are problems with thesis quality, originality, or deadline, you can request a refund.

-

No hidden charges

Our service doesn’t charge extra fees, so you know the final price from the very beginning.

What thesis writing services do we provide

We can write your paper from scratch, make edits required by the supervisor, or assist with a separate chapter (like a literature review or discussion). Whatever thesis writing help you need, the experts will provide it.

Get a custom thesis writing service of the highest quality

We don't compromise the quality – all our thesis writers, editors & quality assurance pros do their best to ensure your 100% satisfaction and supervisor's approval.

-

Only credible & relevant sources

We only use acclaimed databases for professional thesis writing. We critically assess scientific data and set a factual base on any topic.

-

All requirements will be met

This thesis writing service ensures your paper will have the correct length for each section, clear structure & formatting, and right citation style.

-

High accuracy with 2 levels of checks

We provide the highest quality not only for thesis content but also for calculations & complex data analysis, double-checking to ensure accuracy.

-

Download sample Download sample

Thesis

Subject: BiologyWriter: #251225 -

Download sample Download sample

Research Proposal

Subject: Finance and AccountingWriter: #232095 -

Download sample Download sample

Literature review

Subject: Health sciences and nursingWriter: #260844

Enjoy a secure online thesis writing process

There’re stringent safety & privacy policies – we've taken the most effective and advanced measures to make you feel no risk at any stage using professional thesis writing service.

-

Intellectual property protection

Intellectual property protectionOur thesis service never resell, reuse, or share existing written works from our databases. So be sure, your paper is only yours.

-

Privacy protection

Privacy protectionThesis writing process here is completely confidential due to privacy policies, CCPA & GDPR acts, and SSL encryption.

-

Secure payments

Secure paymentsPay for the service with all popular credit/debit cards. We use Ecommpay and Payment wall gateways, so your data is safe.

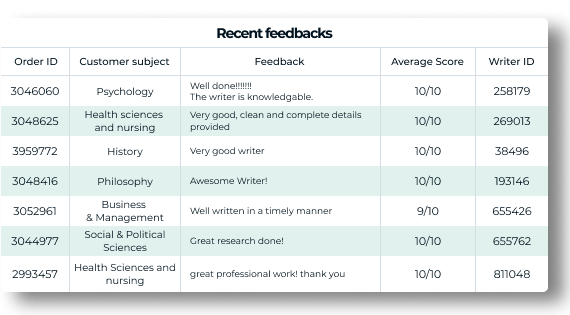

Feedback on our master thesis writing service

Best thesis writing service – what else makes us so

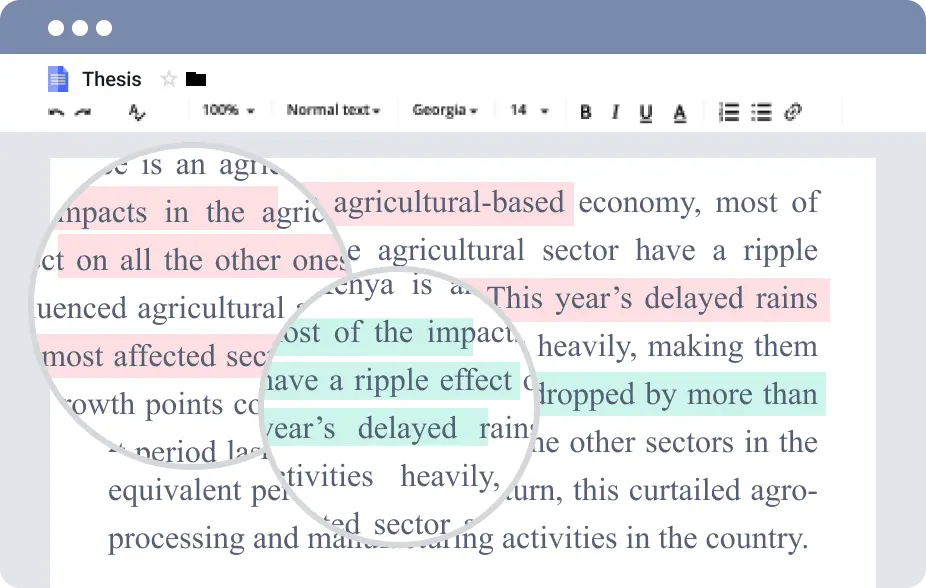

How we prove we write your thesis without plagiarism

FAQs about our thesis writer service

Will my paper pass Turnitin?

Can I request a plagiarism report?

How do you ensure quality?

Are your writers familiar with using SPSS?

What if I’m not satisfied or need revisions?

Can I get my money back?

Can I pay in installments?

Do you verify payments? Will I receive an email confirmation?

Can I track the progress of my order?

Can you write a thesis in 3 days?

Is thesis writing service legal?

Where are you located?

Can anybody detect that I used your platform?

Our Professional Writers Are Already Here to Help You

It doesn’t matter for what reasons you decide to turn to a professional thesis writing service. It’s essential to ensure you get highly competent help from professionals you completely can rely on. And Thesiswritingservice.com is the right place where to receive qualified assistance.

Every writing expert here has practical research experience, holds a PhD/MA, and comes from one of the top-rated colleges. Moreover, they constantly master their performance to maintain the quality of the best thesis writing service. We regularly check it by evaluating the customers’ satisfaction and the rating they set. Only 4.6+/5 writing pros can be assigned to your order.

So whenever you need writing assistance, you have a reliable thesis writing service to consider.

How We Work on Your Thesis

We aim to provide a premier master thesis writing service, maintaining the highest quality at all stages of cooperation:

- We begin with meticulously exploring your instructions to pick up the best-suited writer well-versed in your thesis topic.

- Next, the expert goes through numerous sources & credible databases, selecting materials to use in professional thesis writing.

- Once the first draft is done, it’ll be thoroughly revised and double-checked for instructions compliance and plagiarism.

- After Quality Department approves the paper, you can download it from your personal account & request writing amendments.

The thesis service reps won’t stop until you’re totally satisfied with the paper. We know that it should clearly explain the main ideas and fully cover the topic, provide quantitative and qualitative research methods and results, and be trustworthy and perfectly polished. So be sure you’ll get exactly what you need.

Leave Thesis Writing to Us and Rest Assured of the Best Outcomes

Being a leading service provider since 2010, we’ve built the most proficient way to treat our customers. We offer a wide range of thesis writing services that involve both complete project support and assistance at its separate stages. There are no complicated cases for us, only creative challenges the writers like to cope with.

We strictly monitor writing service quality, collecting customer feedback on-site and on external resources. We constantly analyze this information and use it to make our thesis writing service even better and available for everyone.

So don’t miss the chance to get a grade-boosting paper created per your requirements. Just place an order now!